There is no way to know which items were stolen as opposed to sold, because inventory isn’t being tracked item-by-item.Īssumptions Used in Calculating CoGS under the Periodic Method. They aren’t in inventory at the end of the period, and. Any stolen items will accidentally get bundled up into CoGS, because: For instance, it doesn’t keep track of the cost of inventory theft. Using the equation above, we learn that Corina’s Cost of Goods Sold for November is $2600, calculated as follows: Beginning Inventory Her inventory count at the end of November shows that she has $600 of inventory on hand. Over the month, she purchases another $2,400 worth of books. An inventory count at the beginning of November shows that she has $800 worth of inventory on hand. (And conversely, if an item is in ending inventory, it obviously wasn’t sold, hence the subtraction of the ending inventory balance when calculating CoGS).ĮXAMPLE: Corina has a business selling books on eBay. We then assume that, if an item isn’t in inventory at the end of the period, it must have been sold. This equation makes perfect sense when you look at it piece by piece.īeginning inventory, plus the amount of inventory purchased over the period gives you the total amount of inventory that could have been sold (sometimes known, understandably, as Cost of Goods Available for Sale).

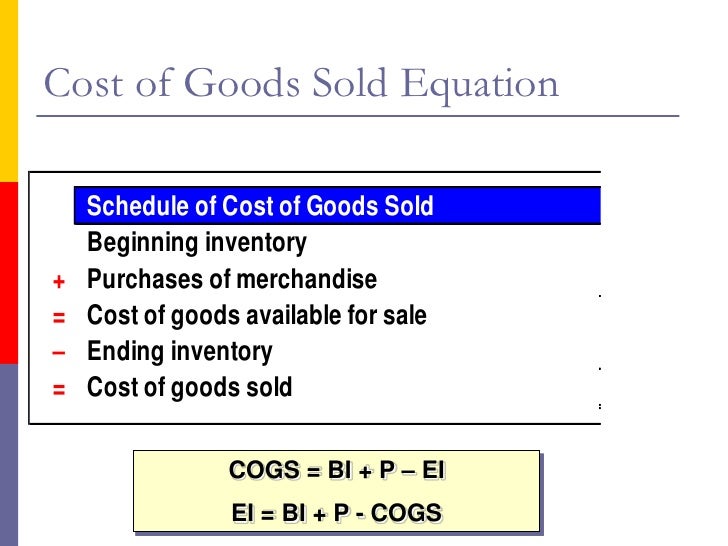

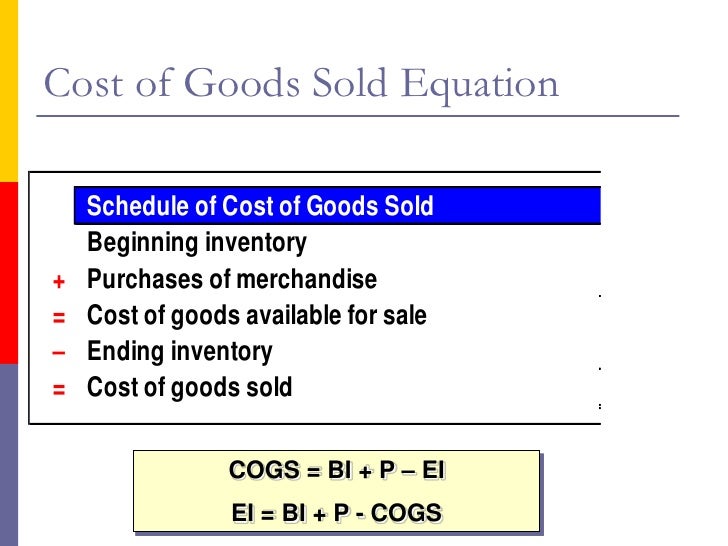

When using the periodic method of inventory, Cost of Goods Sold is calculated using the following equation:īeginning Inventory + Inventory Purchases – End Inventory = Cost of Goods Sold The following is an excerpt from Accounting Made Simple: Accounting Explained in 100 Pages or Less.

0 kommentar(er)

0 kommentar(er)